Here at Pulver CPA Tax and Accounting, we help businesses lower their taxes, we handle all their bookkeeping and tax payments and serve as their outsourced CFO.

You deserve to keep more of your hard earned profits, and taxes are incredibly burdensome.

This article is just a quick overview of how to reduce your taxes as a Florida Small Business and we'd love to help you implement any of them.

If you own a business, don't use regular IRA's and Roth IRA's, you should try to use the small business retirement plans.

You need to offer them to all statutory employees, so be careful if you have any W2 employees.

But small businesses can make "employer" contributions to retirement plans, which essentially avoid the 15.3% social security and medicare taxes (this requires more explanation in a deeper conversation).

The way it lowers taxes is that the business can make a totally deductible employer contribution.

This is not subject to the self employment tax, and it will grow tax deferred.

How much tax can you save with these?

Let's just look at the tax savings power of a SEP IRA or the Solo 401k, since it's simple and quick.

The rule for the SEP IRA, is that the business can contribute the lesser of 25% of the employees contribution, or up to $61,000 (for 2022) read from the IRS here.

This percentage is taken from the salary of an S-Corp, or your net income from a Schedule C.

Let's say you made $100,000. You'd be able to make up to a $25,000 contribution.

You would not pay income tax on that until you drew it out in retirement as a distribution, and even then, you don't pay medicare, FUTA, or social security taxes on it.

Let's say you had an effective tax rate of maybe 20%, and then you have 15.3% in self employment taxes.

That $25,000 contribution into the SEP IRA would have avoided a total of $3,825 in self employment taxes.

You'll end up paying the income tax on the back end, so I won't talk about the $5,000 in income taxes you didn't pay.

A $25,000 SEP IRA Contribution avoids $3,825 in SE taxes!

That's MASSIVE.

That means you're essentially getting a 15.3% return on your investments just by doing it.

I don't always recommend maxing out the other qualified contributions, as the money would be locked up until retirement age of 59.5 years, but the employer contributions are so tax efficient that you MUST maximize them.

I won't dwell on this point for long, but your buy and hold rental real estate is amazing for many reasons.

You can't write off the money you use to make the down payment on a rental property, but nearly every other factor of a rental property is dripping with tax efficiencies.

You should consider adding rental real estate (buy and hold real estate holdings) to your overall investment portfolio.

You could buy a duplex and use one half of the property as your home office, while renting out the other half to a tenant.

Or you could invest in a commercial building, leasing it to your own business and shifting income from a higher tax entity to a lower one.

Depreciation provides massive tax benefits, and you should think this through.

The bottom line is that business owners should create a sinking fund where save up to purchase investment properties.

If you have minor children, you should look into creating real jobs for them and then hiring them.

You can easily shift income out of your high tax bracket, and down into their low tax bracket.

In fact, they will file their own taxes then, and they get the standard deduction of $12,950 in 2022.

A Child's First $12,950 of Income Tax Free!

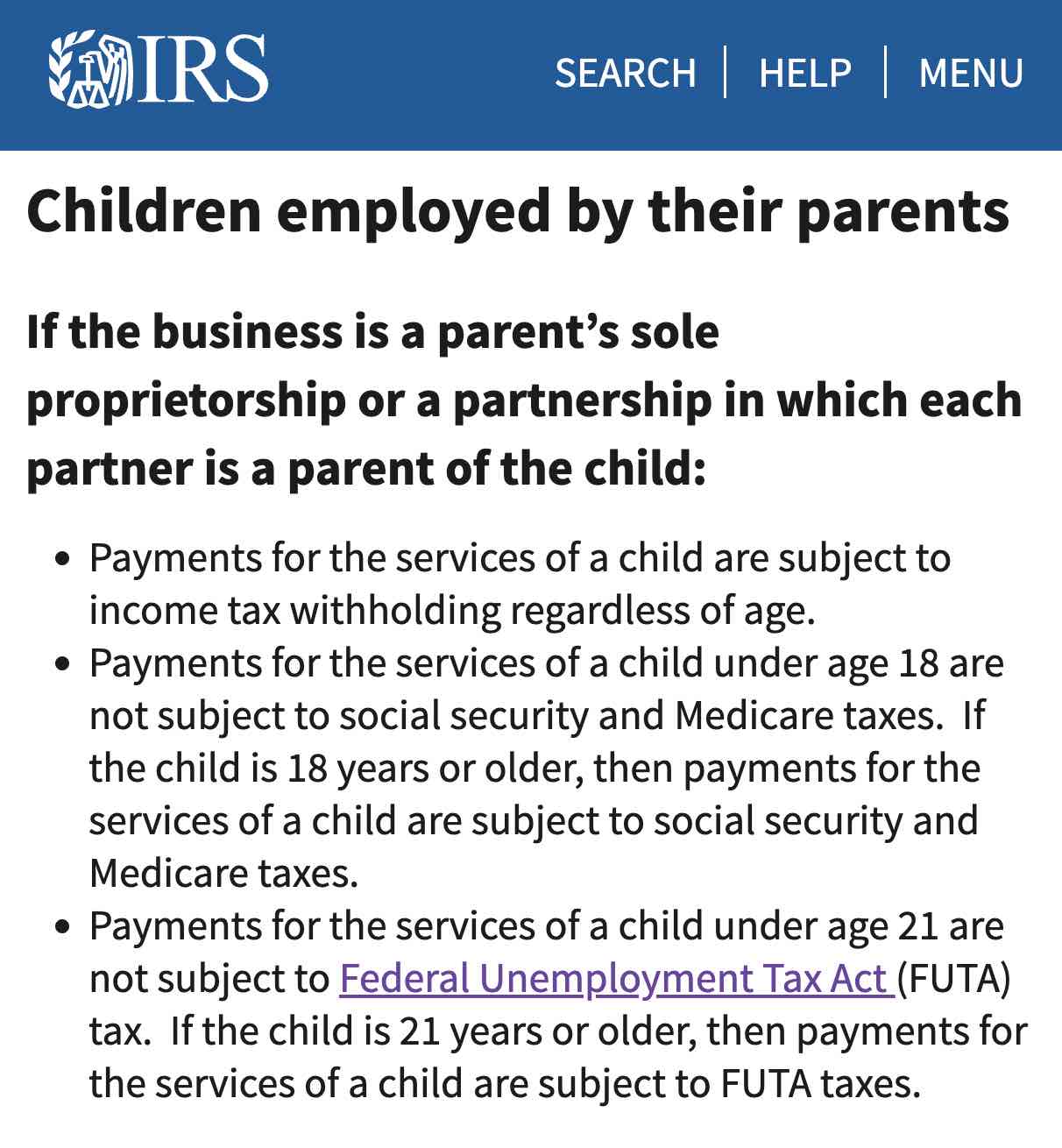

If you're an S-Corp, the wages will be subject to the employment tax of social security and medicare, meaning there's still a 15.3% friction between you and them, but it's different if the business is a disregarded entity or family owned business.

Family owned disregarded entities (fancy word for regular sole proprietorships hiring their legal minor children), can pay their kids in the business and the wages are NOT subject to the social security taxes or medicare taxes.

Kids working in a Family Owned Sole Prop enjoy NO 15.3% Self Employment tax.

Learn about the IRS rules for parents employing their kids here. https://www.irs.gov/businesses/small-businesses-self-employed/family-help

If you want to reduce taxes, and you have children, find ways for them and your spouse to get involved so you can enjoy some really great tax benefits.

Let's say your kid earned $12,000 in a year, and you had an effective tax rate of 20% and the 15.3% in self employment taxes.

That would have saved you $1,836 in SE Taxes, and a total of $2,400 in income tax (20%).

Hiring your kids can teach them about work, entrepreneurship and so much more, so there's BIG time advantages.

Build a lifestyle that's wisely crafted around your business.

You can use your home office deductions to fuel wealth building in a tax efficient manner.

At it's core, the percentage of your home's square footage that's used for business entirely, will dictate how much of a home office deduction you'll enjoy.

But people are starting to realize that they can really enjoy some massive tax benefits while avoiding the commute and rent payment of other offices.

You can add onto your home and make a home office, and then use that entirely for business, and enjoy various different depreciation tax benefits.

Without getting too much into the specifics, you should just understand that the home office NOW, more than ever, is a prime area for massive tax deductions and you should be working with a tax reduction planner to get the most out of it.

Not only that, but you can plan a business vehicle in a major way to maximize tax deductibility, so long as it's really done for legitimate business and you keep good records.

We saved the best for last.

An S-Corp provides a ton of ways to lower self employment taxes.

There are rules and bureaucracy surrounding S-Corporation tax election, but it's nearly ALWAYS the best way to reduce taxes.

An S-Corp is used to split income between a salary, and the owners distribution.

The salary IS subject to the 15.3% self employment tax (medicare and social security), while the distribution portion of the income is NOT subject to the 15.3% SE tax.

S-Corp Owners Distributions are NOT Subject to Social Security or Distributions.

Since the distribution is not subject to medicare and social security, then you'd want to minimize the salary portion of your income and maximize your distribution so you can enjoy the most tax reduction.

The IRS says S-Corp owners MUST take a salary and it must be "reasonable".

The S-Corp can cut employment taxes dramatically.

It's not uncommon to see business owners who were bringing in $150,000 in net profits, suddenly save $4,000 - $10,000 in self employment taxes because they made wise S-Corp decisions.

Here at Pulver CPA Tax and Accounting, we help businesses make the RIGHT decisions around their S-Corps, so book a consultation and we will figure out if converting to an S-Corp is worth it, decide on what your reasonable salary would be and help you with all the payroll and tax forms required to run an S-Corp.